GE Valuation

A detailed valuation of GE, with accompanied analysis for short and long-term outlook was performed. A Discounted Cashflow (DCF), Leverage Buyout (LBO), and Weighted Average Cost of Capital (WACC) using Capital Asset Pricing Model (CAPM) valuation of GE was performed using Excel accompanied with dynamic financial model, Executive Summary, industry analysis, and highlights. Completing 95% of both the Financial Model & Executive Summary including structure, design, and content.

This analysis covers:

- An overview of GE, company description, segments, and financial performance with ratios

- FCF model with accompanied 5-year forecast

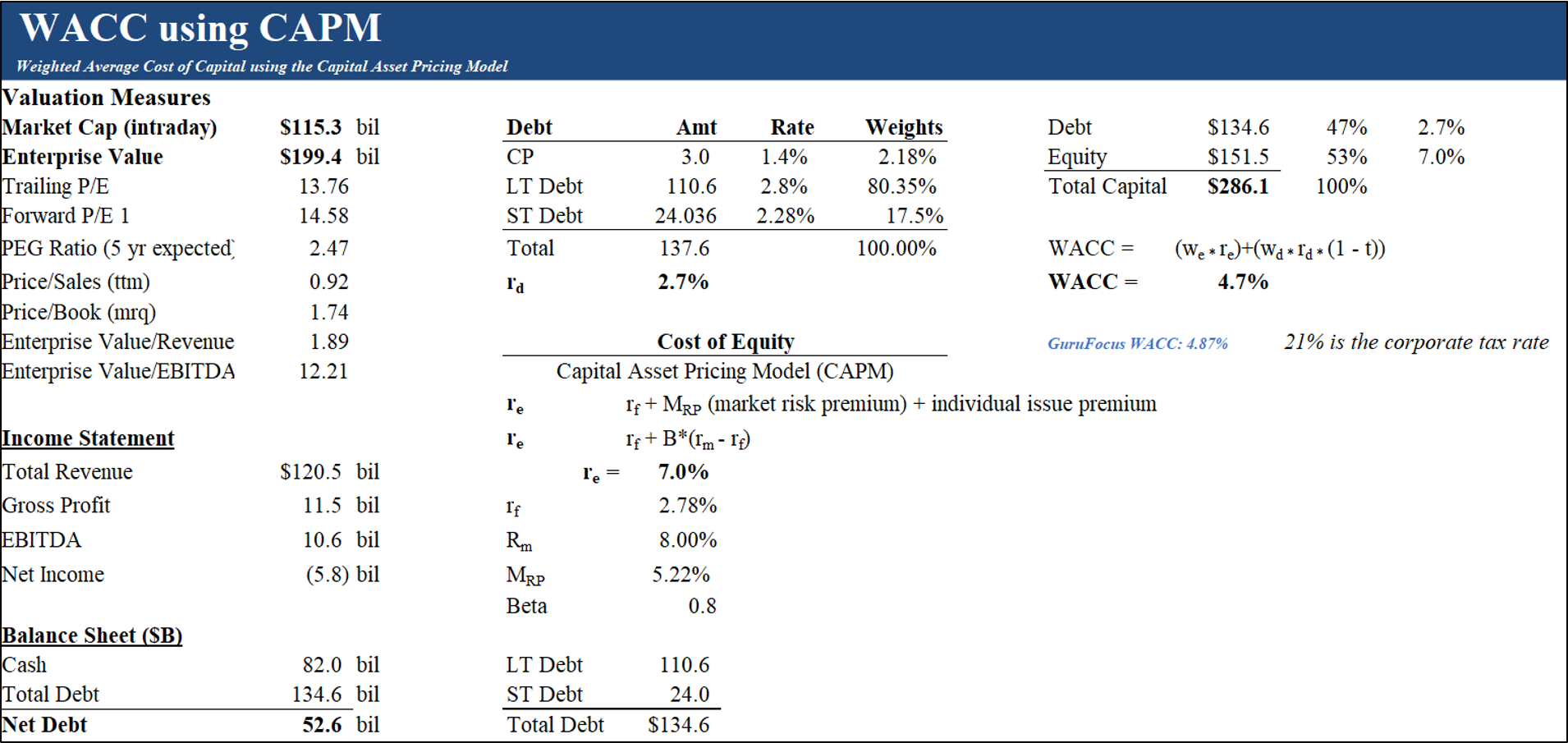

- DCF analysis and WACC using the CAPM method

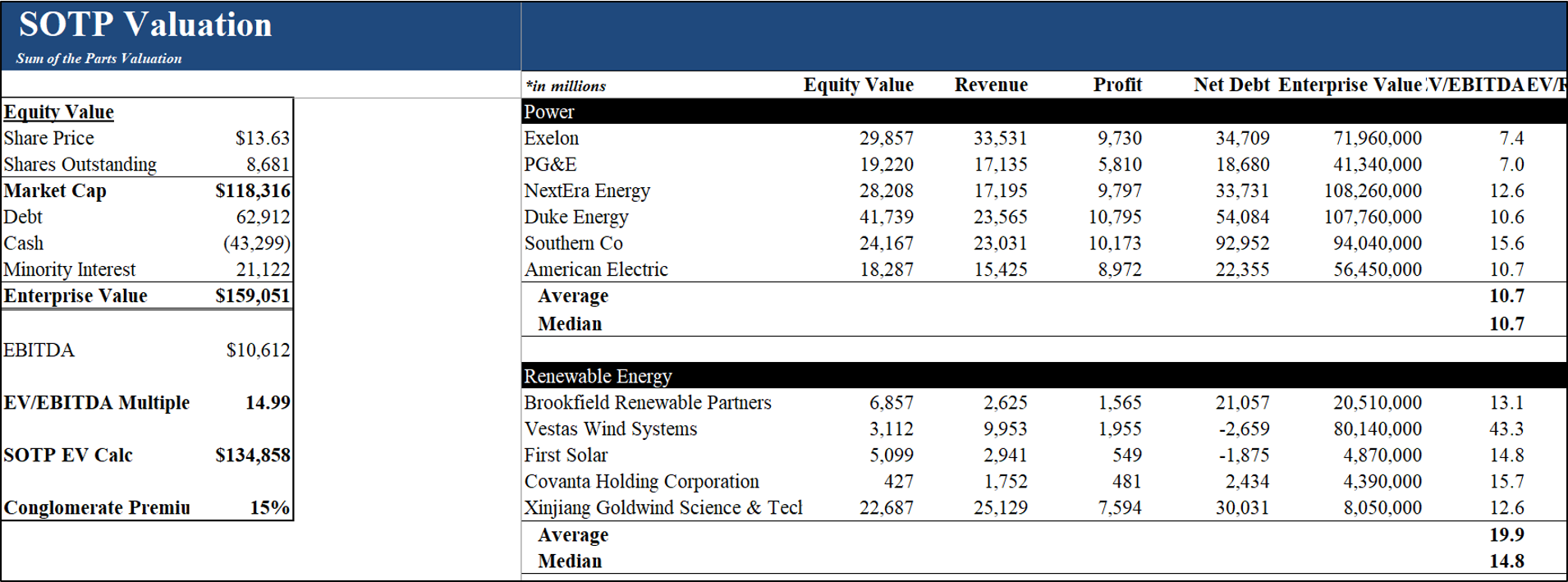

- Sum of the Parts (SOTP) Valuation

Excel Workbook

Executive Summary

Financial Model can be downloaded here.

Executive Summary can be downloaded here.

Overview

General Electric Company is a globally diversified technology and financial services company. The Company’s products and services include aircraft engines, power generation, water processing, and household appliances to medical imaging, business and consumer financing, and industrial products.

DCF Valuation

SOTP Valuation

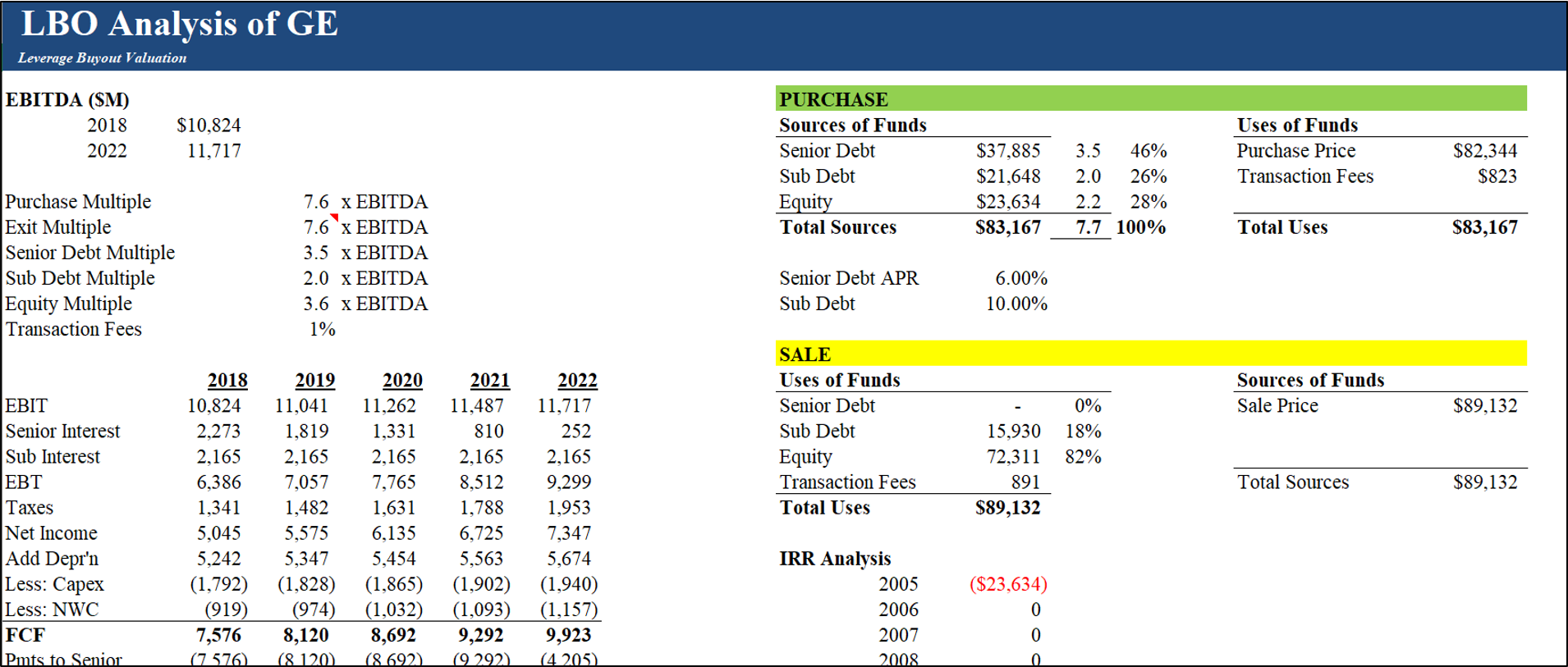

LBO Valuation

Weighted Average Cost of Capital (WACC)

Excutive Summary